An analysis: "Bitcoin is worth exactly 0 - Nassim Taleb"

Nassim Taleb is a renowned scholar having authored several excellent books. He has recently published a research paper “Bitcoin, Currencies, and Fragility” in which his main claim is that Bitcoin is worth exactly zero.

This is an interesting look at the value of Bitcoin and hence I did spend time reading this paper and analyzing the argument in this paper. Of course, I am just starting out in the area of understanding Bitcoin from the non-cryptographic perspective. Yet it was obvious even to me that there are several areas where the author seems to have glossed over the details or ignored facts.

The following is my attempt towards addressing some of the issues raised in this paper. I start out this article by summarizing the phases in the journey of a commodity/collectible towards becoming a currency. Very few commodities survive this journey. I next list the statements of of Nassim Taleb in the research paper above and provide my responses to each of these statements.

Commodity -> Currency : Phases

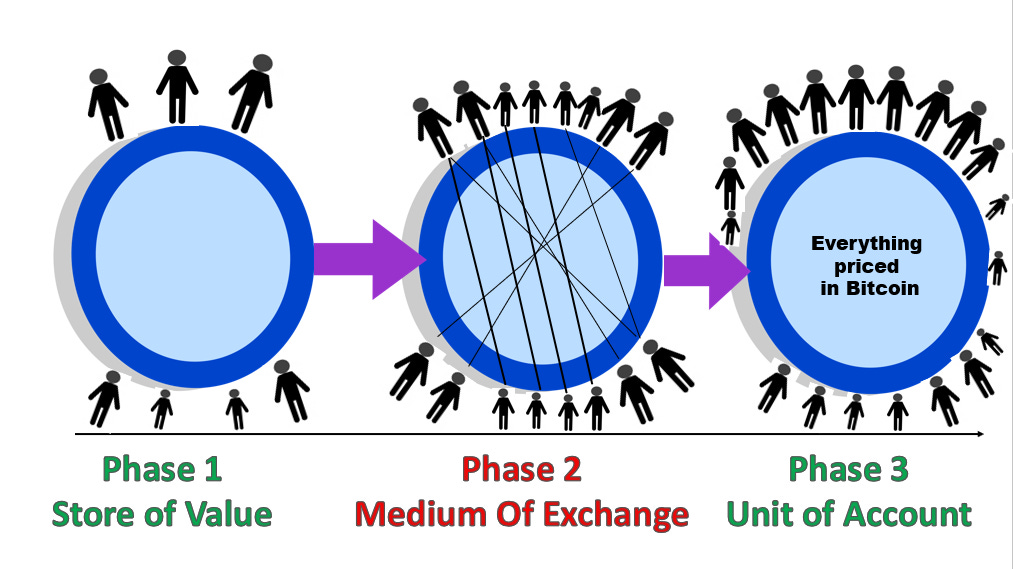

I have already written about the phases that a commodity (or collectible) has to go through before it becomes a currency in this article. As pointed out in that article, a commodity or a collectible goes through three distinct phases before it becomes a strong currency. These phases are

Phase 1: Store of Value

Phase 2: Medium of Exchange

Phase 3: Unit of Account

Details of these phases are given in this article and hence I do not revisit those here. I show these in Figure 1. You can see that in phase 1, very few people use Bitcoin. In Phase 2, the number of people using Bitcoin increases much more and these people exchange goods using Bitcoin. And finally in phase 3, a vast majority of people are comfortable using Bitcoin and everything will be priced in Bitcoin. For more details please check out this excellent article.

Statements from Taleb’s Research Paper

Given below are 31 sentences reproduced as is from the research paper. These sentences are numbered in the order in which they appear in this research paper. My responses appear as a sub-bullet under each item prefixed by FA:.

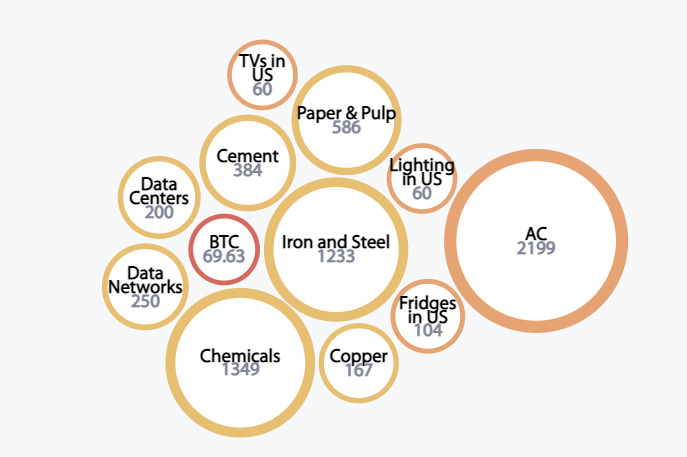

Such adjustments lead to an exponential increase in computer power requirements, making at the time of writing onerous energy demands on the system — energy that could find alternatives in other computational and scientific uses.

FA: Every currency including Bitcoin does require energy to secure it. Think about the gold that you own stored in your bank locker, or the gold bars stored in the bank vaults; or the cash being stored in the ATM stores at every corner or the cash being transported in millions of armored trucks all over the world. They all use energy to secure cash or gold. Not to mention the millions of humans who waste their time transporting cash or ensuring the security of the storage facilities. Bitcoin will avoid the need for all this energy usage while it has its own energy requirements.

FA: People have looked at different aspects of the energy usage. A few images from Cambridge Bitcoin ECI are given below. These are quite favorable for Bitcoin.

A central attribute is that bitcoin depends on the existence of such miners for perpetuity.

FA: Is this not similar to the dependence of fiat money on the armored truck drivers and others for perpetuity. Or similar to the dependence of gold bars in a vault on the guards and alarms systems for perpetuity.

Note that the entire ideological basis behind bitcoin is complete distrust of other operators — there are no partial custodians; the system is fully distributed, though prone to concentration.

FA: The first phase in the journey of a commodity towards becoming a currency is when the commodity is considered a store of value; and very few people trust the value of the commodity to rise. Such believers will naturally hoard the commodity. As a result, the commodity will be prone to concentration. An advantage with Bitcoin though is that anyone with an internet connection, a cell phone and some money can choose to buy or hoard Bitcoin at this stage of its life. This would not be as easy if we were dealing with physical goods on their way to becoming a currency. It would be difficult for people to buy or hoard such physical goods.

Furthermore, by the very nature of the blockchain, transactions are irreversible, no matter the reason.

FA: This is by design. At the same time, I agree that this is completely different from the current behavior that people are used to. So if reversible behavior is needed, we might need to explore the use of smart contracts to provide a behavior like this.

Gold and other precious metals are largely maintenance free, do not degrade over an historical horizon, and do not require maintenance to refresh their physical properties over time.

In that sense Bitcoins created in the past are also maintenance free. Those Bitcoins are captured (as Unspent Transaction Output - UTXO) in an old block and these need not be used until the Bitcoins have to be spent. This is similar to cash stored in an ATM machine being dormant until it has to be spent. One can argue though that we need to spend resources on protecting gold or fiat currency which is lying dormant to prevent theft. This is not the case with dormant Bitcoins.

Cryptocurrencies require a sustained amount of interest in them.

FA: Not sure of the point here. Any currency requires a sustained amount of interest in it since that is a currency.

Earnings-free assets with no residual value are problematic. The implication is that, owing to the absence of any explicit yield benefitting the holder of bitcoin, if we expect that at any point in the future the value will be zero when miners are extinct, the technology becomes obsolete, or future generations get into other such "assets" and bitcoin loses its appeal for them, then the value must be zero now.

FA: We can make the same argument about other commodities used as currencies such as Gold or fiat currency.

FA: It can be argued that Gold will also go to zero if we find a way to produce lots and lots of Gold either via mining or via say alchemy.

FA: it can also be argued that miners will not go extinct given the incentives built into Bitcoin. The number of miners might vary based on the value of the incentives.

FA: I do agree though that advances in technology such as a revolution in quantum computing can make Bitcoin obsolete unless the protocol is modified to incorporate the advances. And the community needs to be responsible for doing this.

The typical comparison of bitcoin to gold is lacking in elementary financial rigor

FA: It depends on what is meant by elementary financial rigor. We will have to compare Bitcoin with Gold when Gold was in a similar phase during its journey. And of course, Internet makes things progress faster on a time scale - like you can communicate with anyone anywhere in the world in seconds as opposed to hours or days or even months as was the case before the Internet. It might have taken hundreds of years for gold to complete the journey from a commodity to becoming a unit of account. I expect Bitcoin to make this journey much faster thanks to the capabilities of the Internet.

Currently, about half of gold production goes to jewelry (for which there are often no storage costs), one tenth to industry, and a quarter to central bank reserves.

FA: It is not correct to say that jewelry has no storage costs. People rent lockers or take other approaches to store jewelry securely. And this does incur a cost.

We cannot expect a book entry on a ledger that requires active maintenance by interested and incentivized people to keep its physical presence, a condition for monetary value, for any period of time — and of course we are not sure of the interests, mindsets, and preferences of future generations.

Active maintenance is not needed for Bitcoins that have already been created. Active maintenance is required to ensure that the Bitcoin transactions are captured accurately. For example, consider a hypothetical scenario after 2140 when no more Bitcoins will be created. Consider a time interval of say an hour or more then when there are no Bitcoin transactions. In such a case, the miners can be expected to turn off mining and not spend money for electricity until some Bitcoin transactions arrive. This can result in a long time duration to mine the next block of the blockchain. But no active maintenance needs to be done during this time to store the old Bitcoins. Of course, in reality if Bitcoin is the currency at that time, you cannot have long durations with no transactions all over the world.

Once bitcoin drops below a certain threshold, it may hit an absorbing barrier and stays at 0 — gold on the other hand is not path dependent in its physical properties

FA: Well gold can also go to zero if we find an easy way to produce lots and lots of it either by advancements in mining or by advancements in alchemy or advancements in space exploration regardless of its physical properties. At this point, the probability of either of those advancements is close to zero and hence Gold still has value.

As discussed in [7], technologies tend to be supplanted by other technologies (>99% of the new is replaced by something newer), whereas items such as gold and silver have proved resistant to extinction. Furthermore bitcoin is supposed to be hacker-proof and is based on total infallibility in the future, not just at present. It is crucial that bitcoin is based on perfect immortality; unlike conventional assets, the slightest mortality rate puts its value at 0

FA: Gold has proved resistant to extinction because of the probability of technical advancements that can impact the value of Gold being close to zero if not zero. An advantage that Bitcoin has here though is the fact that being a software product, it can be upgraded if technological advancements seems to threaten its existence. Of course, there is still a risk that Bitcoin might falter on its way towards becoming a currency but at this point I believe this risk is minimal.

Principle 1: Cumulative ruin - If any non-dividend yielding asset has the tiniest constant probability of hitting an absorbing barrier (causing its value to become 0), then its present value must be 0.

FA: One can make the same argument about Gold or fiat currency. Gold because of advancements in mining or alchemy or space explorations. Fiat because of “money printing” as seen in many countries such as Zimbabwe or Venezuela etc.

We exclude collectibles from that category, as they have an aesthetic utility as if one were, in a way, renting them for an expense that maps to a dividend — and thus are no different from perishable consumer goods. The same applies to the jewelry side of gold and its convenience yield: my gold necklace may be worth 0 in thirty years, but then I would have been wearing it for six decades.

FA: Probably one can argue that my Bitcoin holdings can also be used to claim superiority in my group of friends. Also note that not every collectible has an aesthetic utility.

Bitcoin would be allowed to escape a valuation methodology had it proven to be a medium of exchange or satisfied the condition for a numeraire from which other goods could be priced. But currently it is not, as we will see next.

Bitcoin is still in the vary first stage - the stage corresponding to store of value. Second and third stages correspond to Bitcoin being used as a medium of exchange and as a unit of account respectively.

the fundamental flaw and contradiction at the base of most cryptocurrencies is, as we saw, that the originators, miners, and maintainers of the system currently make their money from the inflation of their currencies rather than just from the volume of underlying transactions in them. Hence the total failure of bitcoin to become a currency has been masked by the inflation of the currency value, generating (paper) profits for a large enough number of people to enter the discourse well ahead of its utility.

FA: I assume the author here is referring to the increase in the price of Bitcoin when priced in fiat currency such as US Dollars when the author refers to the inflation of their currencies. But as I have shown in my article referred to above, the rise in price of Bitcoin follows from the stage that Bitcoin is in on it’s way to becoming a currency. Bitcoin might still fail to become a currency (which might happen if Governments start using sound money principles for fiat currency as referenced by Saifedean) but the chances of failure appear quite low at this point.

Transactions in bitcoin are considerably more expensive than wire services or other modes of transfers, or ones in other cryptocurrencies. They are order of magnitudes slower than standard commercial systems used by credit card companies —anecdotally, while you can instantly buy a cup of coffee with your cell phone, you would need to wait ten minutes if you used bitcoin. They cannot compete with African mobile money. 9. Nor can the system outlined above —as per its very structure —accommodate a large volume of transactions —which is something central for such an ambitious payment system.

FA: The issues with Bitcoin pointed out above are well known. And there are solutions such as the Lightning Network proposed to address these. Interested readers can read up on Lightning Network (LN) or wait for a future article from me on this topic. But LN ensures that transactions can be executed within milliseconds. In addition, the cost of each transaction is very small. Finally, LN also allows for Visa/Mastercard scale transactions per second while using the Bitcoin blockchain.

To date, twelve years into its life, in spite of all the fanfare, but with the possible exception of the price tag of Salvadoran permanent residence (3 bitcoins), there are currently no prices fixed in bitcoin floating in fiat currencies in the economy.

FA: I believe this is because Bitcoin is still in the first phase of being a “store of value”. It is slowly migrating to the phase of “Medium of exchange” which is what the author refers to above.

the most robust theory is that there was not enough gold to keep up with economic growth Furthermore, there had been long debates over the hampering of monetary policy by sticking to metals, as witnessed by the bullionist controversy. At the time of writing, 41 years later, neither gold nor silver have, inflation adjusted, reached their previous peak.

FA: I will ignore this since this is referring to Gold vs the fiat currency.

Gold and silver proved then that they could neither be a reliable numeraire, nor an inflation hedge. The world had become too sophisticated for precious metals. If we consider the most effective numeraire, it must be the one in which the bulk of salaries are paid, as we will show next.

FA: The author should investigate why gold lost its position as a medium in which bulk of salaries are paid. It has to do with a combination of the inability of gold to be easily transported over distances securely and of the tendency of banks to make a quick buck leveraging this weakness of gold. This lead to issues such as fraud due to which the government stepped in to avoid such fraud. But then the temptation to create money out of thin air proved too tempting for the government and hence we now have fiat money being created out of thin air.

There is a conflation between "accepting bitcoin for payments" and pricing goods in bitcoin. To "price" in bitcoin, bitcoin the price must be fixed, with a conversion into fiat floating, rather than the reverse.

This “accepting bitcoin for payments” is related to the second stage while “pricing goods in Bitcoin” is related to the third stage of the journey of a commodity towards becoming a currency. And Bitcoin is still in the first stage. A child has to crawl before it can walk and it has to walk before it can run. You will be called stupid if you look at a one month old child and state it’s not a human being since the child cannot walk or run.

All this requires a parity in bitcoin-USD of low enough volatility to be tolerable and for variations to remain inconsequential.

FA: I expect this to happen when Bitcoin reaches the third stage of “unit of account”.

But the new currency just needs to be more appealing as a store of value by tracking a weighted basket of goods and services with minimum error.

FA: The author here is focused on proposing a new currency. This can be a commodity or a good better suited to be a currency as compared to Bitcoin. I consider this as an area of research and definitely support this. At this point though I am not aware of any such commodity.

During the 1970s, the Italian national telephone tokens, the gettoni, were considered acceptable tender, almost always accepted as payment.

FA: We can explore the gettoni also using the Currency Evaluation Framework. That will show why it was not well placed to traverse the journey from a commodity to a currency.

Simply, there is a free market for fiat currencies, with the most reliable at the time used by third parties.

FA: The fiat currencies can also be evaluated using the Currency Evaluation Framework. In addition, the fiat currency have an element of compulsion associated with them. But even this element of compulsion is not sufficient to force the use of the fiat currency in some situations such as observed in case of highly inflationary scenarios such as in Zimbabwe, Venezuela etc.

Libertarianism is about the rule of law in place of the rule of regulation. It is not about the rule of rules.

FA: I assume this remark is related to the issue of smart contracts. I do agree that smart contracts cannot be changed once loaded on the blockchain. However, smart contracts can be deleted and new ones uploaded if the situation changes. This feature can be used to upgrade the rules encoded in the smart contracts. And the users of the system can interact with the appropriate smart contract without any compulsion.

The experience of March 2020, during the market panic upon the onset of the pandemic, when bitcoin dropped farther than the stock market —and subsequently recovered with it upon the massive injection of liquidity is sufficient evidence that it cannot remotely be used as a tail hedge against systemic risk. Furthermore, bitcoin appears to respond to liquidity, exactly like other bubble items.

FA: I believe this is again because Bitcoin is still in the first phase on its journey to become a Currency. During this phase, the value of Bitcoin depends on what the people holding it think it is going to be worth. And the thinking of these people is impacted due to situations such as the market panic, inflation in the fiat system etc.

It is also uncertain what could happen should the internet experience a general, or an even a regional, outage — particularly if it takes place during a financial collapse.

FA: This seems as hypothetical a scenario as the scenario of what could happen if all oxygen on earth disappeared for a few minutes. We will have bigger things to worry about in both scenarios. Human life is so much dependent on the Internet at this time that there would be lot of human lives lost. And Bitcoin should still be fine since storage of old blocks will not be impacted given the distributed nature of storage. And the generation of a new block will be delayed until the outage can be fixed either locally or globally.

Fallacy of safe haven, II (protection from tyrannical regimes):

FA: I agree that Bitcoin does not provide complete anonymity. It is possible to connect the Bitcoin transactions in some situations. One such loophole in the way of connecting to the Bitcoin network was used by the FBI to track down Ross Ulbricht. This though is not an issue with the bitcoin protocol. With Bitcoin, people in tyrannical regimes at least have an opportunity to protect themselves if they take the proper precautions during the use of Bitcoin. These precautions are much less stringent as compared to the precautions to be used by such people if they have to use gold or fiat currency.

The slogan "Escape government tyranny hence bitcoin" is similar to advertisements in the 1960s extolling the health benefits of cigarettes.

FA: I will ignore this statement since this is just a personal opinion.

Unfortunately, there appears to be a worse agency problem: a concentration of insiders hoarding what they think will be the world currency, so others would have to go to them later on for supply.

See my response to the third item above. The answer here is similar.

Summary

Based on my detailed analysis I do not agree with Nassim Taleb’s statement that Bitcoin is worth exactly zero. I agree that there are risks in the journey of Bitcoin towards becoming the best currency on earth but the probabilities of these risks are minimal at this time.