Virtual currencies - Evaluation Framework

In a previous article, I looked at the two types of virtual currencies - egov coins and crypto coins.

In this article I will consider a framework that I call as the Currency Evaluation Framework (CEF) to compare these currencies. I consider specific examples of virtual currencies. I use specific examples for two reasons namely

Since there is no implementation of an egov coin (ignoring the Sand dollar implemented by Bahamas). And each egov coin could be different once it is implemented. Hence I focus on a hypothetical Digital Dollar. I make assumptions about how such a Digital Dollar might be implemented.

Since there are several crypto coins in existence and they differ based on various characteristics. Hence I focus on Bitcoin.

Summary

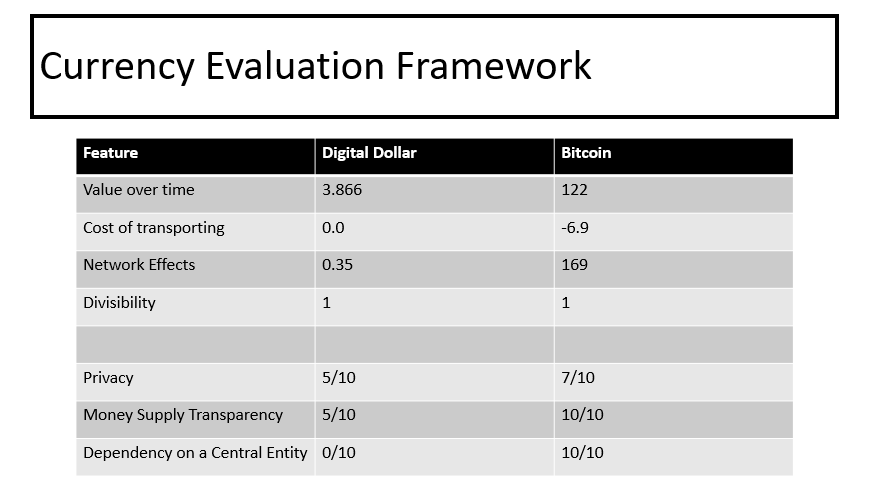

The results using the Currency Evaluation Framework (CEF) for Digital Dollar and Bitcoin are given in the figure below. We see from here that Bitcoin is much better than the Digital Dollar when you consider various features that are necessary or desirable in a currency. Read on for an explanation of these features and for a justification of the scores below.

The rest of the article is organized as follows. I start by explaining the Currency Evaluation Framework (CEF) and the features that make up the CEF.

Following that I explain the scores in the above figure for Digital Dollar and Bitcoin.

Currency Evaluation Framework (CEF)

Any commodity can become currency over the long run. But to do that the commodity has to satisfy some basic requirements. I have combined these requirements into what I call as the Currency Evaluation Framework (CEF). I next explain the CEF as I am proposing it now. I expect CEF to evolve in the future.

CEF consists of three types of features namely

Necessary features : There are 4 features in this category.

Desirable features : There are 3 features in this category.

A list of all features in both categories are shown in the figure below.

I next explain these features in detail. A metric is associated with every feature since that will make it easy for comparison. These metrics do not follow the formal definition of metrics. Rather, these are intended to be used as informal measures to help us with our comparison of various currencies. I explain the metric when explaining the primary features.

Necessary features

There are four necessary features namely

Value over time

Cost of transporting

Network Effects

Divisibility

Value over time

Commodities that became currencies in the past typically had their value increase over time. Commodities that could not preserve or increase value over time lost their position as a currency. So this seems like a necessary feature of a good or sound currency.

A quantitative metric proposed by others (Bitcoin Standard, Plan B) that I like to use to determine the value of a commodity over time is Stock to Flow (S2F) ratio. This represents the ratio of the amount of the commodity that exists today to the amount of the commodity that can be created in say a year. This ratio illustrates the number of years it takes to double the quantity of the commodity. The higher the S2F value the better the commodity is suited to be a currency.

For example Gold currently has a S2F ratio of around 55. This is based on the current expectations of Gold production. And if we find an approach to produce lot of gold every year then this ratio will collapse. And gold will then lose its position as a currency.

Bitcoin has a S2F ratio of around 56 these days (18.5 million bitcoins mined so far and 328,500 bitcoins expected to be mined this year) and this is expected to exceed 100 in the next few years.

As another example, think about cigarettes serving as currency in prison. The value of cigarettes in prison will go up if the S2F ratio goes up. And this can happen if say the authorities crack down on smuggling of cigarettes into the prison.

This feature is also related to other properties that a currency needs to have such as the properties of authenticity, ability to prevent double spending, durability and limited supply.

If it’s difficult to prove the authenticity of the currency in question then it will be easy to produce fake instances of the currency thereby reducing the S2F ratio. A currency that does not have the ability to prevent double spending will also result in fake instances of the currency thereby resulting in a reduced S2F ratio.

A highly durable currency also results in increased S2F since the currency can survive for generations. A high S2F also ensures that there is a limited supply of the currency which prevents issues such as inflation.

Cost of transporting

Going by past history, it was necessary for a currency to be easy to transport across small or large distances. In other words, it should be portable. I do not use the term portable directly since portable can have other connotations such as being portable across software systems.

Gold is not easily transportable and hence that is a negative for gold as currency. It can be argued that this did lead to the concept of paper currency backed by gold since paper currency is much easier to transport. And this backing was done by a trusted third party which over time got corrupted and started “printing” paper currency not backed by gold. These are issues that I will look at in a separate article in the future.

In today’s digital world, though physical transportation of currency is not important. What is important though is for any two people anywhere in the world to be able to transact with each other.

Therefore, the metric I use to evaluate the transportability of a currency is the cost associated for one person to pay a different person using the currency in question when both of them are not in the same geographical location. I consider this with a negative sign in the table since this is a cost.

Network Effects

The value of currency also goes up when more number of people start using it. Think about a scenario where everyone is using silver as currency and you want to use gold since it has a higher S2F ratio compared to silver. In that situation, it will still be difficult for gold to supplant silver as the currency even though it has better values for the CEF features.

A metric that I use to measure network effects is the increase in the number of people using the currency over the past year divided by the number of people using the currency a year back.

Divisibility

It should be possible to divide the currency into subunits. How many subunits are desirable. I do not have an answer for this.

For my metric, I use the following two questions.

Is the currency divisible into at least 100 subunits and

does it have units corresponding to billion US dollars available currently.

This is a completely whimsical metric. Probably I might change this in the future. I assign a value of 0.5 for each “yes” to the questions above.

I next consider the secondary features. I do not use metrics for the secondary features. Instead I use a scoring system that I explain for each feature.

Desirable features

Privacy

Money Supply Transparency

Dependency on a central entity

Privacy

A currency should also provide for privacy. Privacy would allow the owner of the currency to spend it without anyone being aware of where it is being spent. This has two aspects namely

Privacy from authorized parties such as the government.

Privacy from other customers who use the currency.

I score this feature on a scale of 10. A currency that provides complete privacy from both the government and from other customers is scored as a 10. A currency that provides no privacy from authorized parties but provides complete privacy from other customers is scored as a 5. And partial privacy on either of these scales is scored accordingly.

Money Supply Transparency

It would be great to be able to have complete visibility into the supply of the currency. This includes not only the knowledge about the current availability of currency but also the knowledge about the future supply of the currency.

I score this feature also on a scale of 10. A currency that provides full visibility into how it was created and how much of it a

Dependency on a central entity

I consider dependency on a central entity as a desirable feature and not a necessary feature. To understand my reasoning, consider a currency that depends on a central bank for creation and maintenance. If the central bank follows sound principles to create and maintain this currency then it will be a strong currency regardless of the dependency on the central bank. The sound principles will ensure that the necessary conditions given above are satisfied.

The challenge though is that it is a slippery slope to go from a central bank that has agreed to follow sound principles to a central bank that breaks its promise due to other constraints. We have seen this in the past when central banks promised to create paper currencies back by gold which was the gold standard. But then they broke their promise once the situation changed.

It is due to this “slippery slope” that I even consider this feature. I score this feature also on a scale of 10. A currency system that does not depend on a central entity at all gets a score of 10 while a currency system that depends completely on a central bank gets a score of 0.

Other considerations

There are other properties such as the following that are desirable. But I believe that these can be addressed by implementation and hence do not focus on these when comparing different types of currencies.

Programmability of currency: This is an indication of the ability to specify rules in software about how the currency can be used in transactions. I expect this will become important in future especially when comparing the existing systems with egov-coins and crypto coins.

Friction of Transactions: This is an indication of how difficult it is to execute transactions using the currency.

Irreversible Transactions: This is an indication of whether a transaction can be cancelled after the fact.

Ease of Migration from existing system to new system: This is an indication of how much education is needed to help the users understand the new way of doing business.

CEF Scores for Digital Dollar and Bitcoin

I next justify the scores that I have provide using the CEF framework for both Digital Dollar and Bitcoin.

Value over time

In order to determine the S2F metric for Digital Dollar, I assume

The supply of Digital Dollar will be similar to the supply of US dollars last year.

That the M3 supply is representative of this.

M3 is a measure of the cash, checking deposits, large time deposits, institutional money market funds, larger liquid funds etc.

The M3 supply in Jan 2020 was $15.41T and in Jan 2021 was $19.396T. Hence this metric has the value 3.866 for Digital Dollar.

For Bitcoin, it is easy to determine the S2F ratio for any given year since the schedule of creating new Bitcoins is set in stone. I focus on the year 2025 for Bitcoins. And for that year we can see that the S2F value for Bitcoin will equal 122.

Note that the S2F metric of Bitcoin keeps increasing every year since the stock goes up every year while the flow decreases by half every 4 years.

Cost of transporting

To determine the value of this metric for Digital Dollar, I assume that the transaction fees will be zero for any transaction between people based in the US. This can change and we can have fees similar to the wire transfer fees that exist currently. In addition, the cost here is expected to be non-zero when transacting between people using egov-coins of different countries.

Hence I assume a cost of 0 to transact using Digital Dollar.

On the other hand, I assume the associated cost for Bitcoin here is the average transaction costs for any Bitcoin transaction over the last 30 days. I see that this value is $6.9 over the last 30 days (checked on July 10 2021).

Network Effects

This metric defined earlier shows the increase in number of people using this currency. For the digital dollar I assume that this is the same as the value for the paper currency that exists now. And this in turn is related to the increase in the population of people using the US dollar as currency now. While several countries use US Dollar as currency, the vast majority are the people who reside in US. Hence I consider the increase in US population over the last year to represent this.

This value is 0.35% and hence this metric has the value 0.35 for the digital dollar.

This metric for Bitcoin is computed by using data from Coinbase - the largest exchange in the US. We look at the number of new users reported by Coinbase to estimate this metric for Bitcoin. Coinbase reported 13 million verified users of Bitcoin in late 2019 and 35 million verified users across 100 countries in late 2020. Hence this growth of new users of Coinbase using Bitcoin is 169%. Hence the value of this metric for Bitcoin is 169 as shown in the table.

Divisibility

Both Digital Dollar and Bitcoin are divisible according to the criteria given above. Hence I assign a score of 1 to both currencies for this feature.

Privacy

Any transactions done using the Digital Dollar will be completely visible to the Central Bank and any other entities that the Central Bank allows in the circle of trust. I also expect that the Digital Dollar when implemented will hide details of such transactions from people who are not involved in the transaction. Hence I assign a score of 5/10 to Digital Dollar for this feature.

Any transaction done using Bitcoin will be visible to everyone. However, the identity of the parties involved in the transaction might not be obvious. Uncovering the real identity of the participants of a transaction while not impossible, takes some effort. Hence I assign a score of 7/10 to Bitcoin for this feature.

Money Supply Transparency

The amount of information available about the money supply for the Digital Dollar depends on the amount of information that will be released by the Central Bank. I have no idea how this is going to turn out in the future given that the Central Bank is “printing Dollars” currently and is expected to continue to do so. As a result, I pick a score of 5/10 for Digital Dollars.

The amount of Bitcoins created and that will be created in the future is known. And no deviation in this plan is expected. Hence I assign a score of 10/10 for Bitcoin for this feature.

Dependency on a central entity

Digital Dollar depends completely on a central bank. Hence I assign it a score of 0/10 for this feature.

Bitcoin has no dependency on a central entity. This is the case now and this is the case expected for all time. Hence, I assign it a score of 10/10 for this feature.

Summary

In summary, we see that Bitcoin is much more attractive compared to my assumed implementation of a Digital Dollar if we consider the various metrics in CEF. In future articles, I will use this framework to evaluate other crypto coins also.

If you liked this article please share this with your friends using the Share button below.